Source: Simply Business

Buying property in the right areas is crucial for landlords, so where in the UK can you benefit from attractive returns in 2023?

Read on to find out the top towns and cities attracting property investors and where landlords new to the market are buying properties.

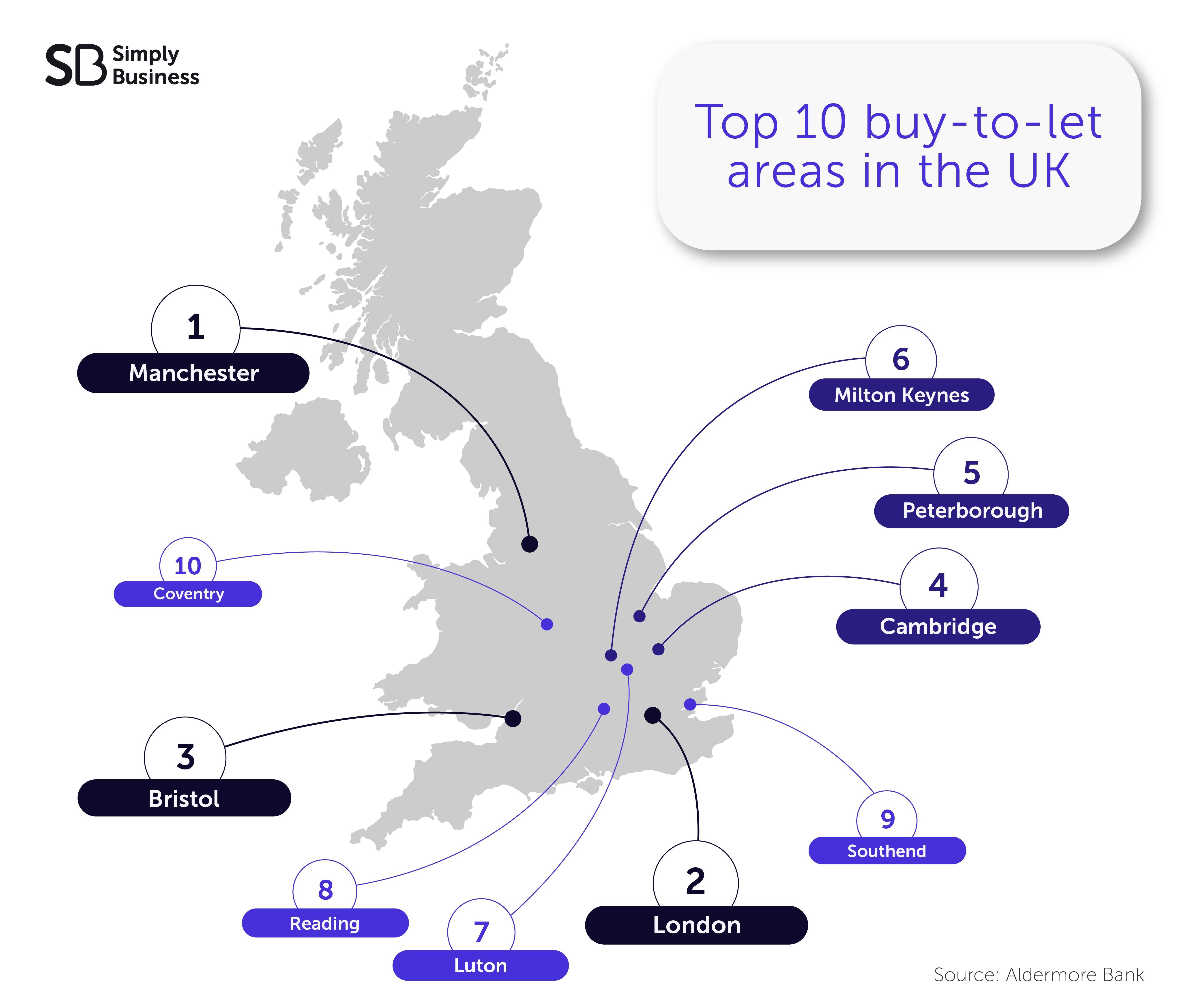

Where are the best places to invest in property in the UK?

Manchester is the number one location in Aldermore Bank’s buy-to-let city tracker, which ranks the UK’s best areas for buy-to-let. The city in the North West rises from fourth in last year’s rankings, reclaiming the top spot from Bristol which has fallen down to third.

Aldermore’s tracker is based on five key factors which combine to make investment locations appealing to landlords:

- average total rent

- short-term returns through rental yield

- long-term returns through house price growth

- the lowest number of vacancies as a proportion of total housing stock

- percentage of the city population in the rental market

Here are some of the key findings from the latest research:

- Manchester is ranked top, thanks to its long-term property growth (annual average of 5.6 per cent), plus strong tenant demand with almost a third of residents (31 per cent) renting privately

- ranked second and third respectively, London and Bristol are once again seen as profitable investment locations after coming sixth and first in 2022

- Milton Keynes and Peterborough shot up 28 and 11 places respectively to enter the top 10. This is largely due to the areas being increasingly popular with commuters since the pandemic

- a strong performance from Essex areas Southend, Basildon, and Chelmsford. Again, this could be down to the proximity of these areas to London

- significant drops for Midlands cities Northampton, Leicester, and Derby. However, rankings for Birmingham and Nottingham improved by eight and nine places respectively

Top 25 buy-to-let areas in the UK

| 2023 ranking | Area | Region | Overall score | 2022 ranking |

| 1 | Manchester | North West | 73 | 4 (+3) |

| 2 | London | London | 73 | 6 (+4) |

| 3 | Bristol | South West | 73 | 1 (-2) |

| 4 | Cambridge | East | 68 | 3 (-1) |

| 5 | Peterborough | East | 67 | 16 (+11) |

| 6 | Milton Keynes | South East | 66 | 34 (+28) |

| 7 | Luton | East | 64 | 5 (-2) |

| 8 | Reading | South East | 64 | 9 (+1) |

| 9 | Southend | East | 63 | 11 (+2) |

| 10 | Coventry | West Midlands | 63 | 12 (+2) |

The remaining towns and cities in the top 25 best areas for buy-to-let are:

- Oxford, South East (overall score: 61)

- Basildon, East (overall score: 61)

- Norwich, East (overall score: 60)

- Brighton, South East (overall score: 59)

- Nottingham, East Midlands (overall score: 59)

- Birmingham, West Midlands (overall score: 57)

- Glasgow, Scotland (overall score: 57)

- Southampton, South East (overall score: 56)

- Swindon, South West (overall score: 56)

- Chelmsford, East (overall score: 56)

- Edinburgh, Scotland (overall score: 54)

- York, Yorkshire (overall score: 54)

- Portsmouth, South East (overall score: 52)

- Northampton, East Midlands (overall score: 52)

- Maidstone, South East (overall score: 51)

Where are new landlords investing in property?

Research by Simply Business has identified the buy-to-let areas that are most popular with new landlords.

We looked at which areas had the most landlords who’ve owned property for less than a year and taken out landlord insurance in 2022.

London came top, followed by Manchester, Birmingham, Liverpool, and Nottingham. It’s interesting to note that the top five buy-to-let areas for new landlords are all major UK cities where tenant demand is likely to be high and property price growth likely to be steady.

The top ten was made up of:

- Glasgow

- Leeds

- Bristol

- Edinburgh

- Hull

All of these areas have well-known universities. Letting to students is often popular with new landlords due to the lower acquisition costs, annual demand, and potential for high rental yields.

Where are the best investment properties for HMO landlords?

Houses in multiple occupation (HMOs) are larger properties that can be let to three or more people from more than one household who share living facilities.

For example, a house share of five young professionals would count as a ‘large HMO’. Read our guide to HMOs for further details.

To successfully let an HMO, you need to be operating in the right market – somewhere with lots of students or young professionals could be an ideal location.

If you’re looking to buy and rent out a larger property, here are the top five hotspots where we saw the most HMO landlords take out insurance during 2022:

- London

- Birmingham

- Bristol

- Manchester

- Cardiff

It’s no surprise that all of these cities have multiple universities and strong employment markets, making them popular with young professionals – and so appealing to HMO landlords.

Revealed – popular buy-to-let investment areas by property type

The type of property you rent out is likely to have an impact on the prospective tenants it attracts.

For example, houses could be more popular with families, while flats may appeal to young professionals, and bungalows could be more suitable for older renters.

We’ve taken a closer look at where the most landlords took out insurance policies for different property types during 2022.

Houses

The top hotspot for detached houses was Nottingham, while London was most popular for terraced and semi-detached houses. Birmingham was also popular with landlords who own houses, featuring in the top five for all types of house.

Bungalows and maisonettes

London was the most popular location for landlords renting out maisonettes, followed by Birmingham, and Southampton.

Meanwhile, Nottingham, Leicester, and Norwich were the top buy-to-let areas for bungalows.

Flats

The top UK area for flats was London, followed by Scottish cities Glasgow, Edinburgh, and Aberdeen, with Manchester making the top five.

The worst buy-to-let areas

Aldermore’s data suggests that locations in Wales are once again less appealing for landlords. Swansea and Newport took the bottom two spots of the top 50, while Cardiff came in at 43rd.

A poor performance in Wales could be down to an oversupply of rental property. This could lead to lower average rental prices and yields, making it a less attractive investment location.

Welsh landlords also have to consider changes to the law in December 2022, which replaced tenancy agreements, extended notice periods, and increased expectations around property conditions.

Here are the bottom 9 areas in the list:

- Doncaster, Yorkshire (overall score: 37)

- Dundee, Scotland (overall score: 35)

- Cardiff, Wales (overall score: 34)

- Aberdeen, Scotland (overall score: 33)

- Bradford, Yorkshire (overall score: 31)

- Wolverhampton, West Midlands (overall score: 30)

- Sunderland, North East (overall score: 30)

- Newport, Wales (overall score: 21)

- Swansea, Wales (overall score: 15)