| The prevailing question of whether it is wise to invest in buy-to-let property during times of “high” interest rates is becoming increasingly common in today’s economic landscape – and the answer is yes, it is wise. In recent times, we have witnessed a departure from the era of exceptionally low interest rates. The Bank of England has consistently raised the base rate, leading to higher mortgage rates compared to previous years. While this poses challenges for the housing market, the underlying advantages of investing in UK property remain largely intact. For those who adopt a long-term perspective, the off-plan, buy-to-let sector continues to present opportunities for individuals seeking to invest in tangible assets. |

- Record High Rental Income

Astute investors can leverage the decline in demand among prospective homebuyers to their advantage. As individuals postpone their plans to purchase property, they turn to the rental market instead, creating a surge in demand from potential tenants looking for high quality city centre rental accommodation. This situation presents two distinct benefits for investors. Firstly, they gain access to a broader range of reliable and high-quality tenants, enhancing the selection process. Additionally, the increased demand leads to higher rental incomes, amplifying the return on investment and significantly offsetting the impact of rising mortgage costs.

This trend is already evident in recent data provided by Zoopla, indicating a substantial rise in average monthly rent. The figures reveal an increase of £110 per month, or 10.9%, compared to the corresponding period last year, with the average now reaching £1,120 per calendar month. Some cities, such as Manchester, have even experienced staggering rental growth as high as 23% in the last 12 months alone.

See below for the average rental price growth over the last 5 years in some of the the UK’s best performing cities. Source: JLL Big Six Residential Development Report 2023

2. No Mortgage Until Completion

Investing in off-plan properties offers the advantage of not needing to secure a mortgage until a few months before completion. Depending on the development you choose to purchase in, this could be anything from 6 months to 5 years. This provides flexibility and time for investors to arrange their finances, compare mortgage options, and secure favorable terms. It also allows for efficient capital allocation and potential cost savings.

Additionally, the delay in securing a mortgage mitigates the risk of potential fluctuations in interest rates, providing investors with the opportunity to reassess and potentially secure a mortgage at a more advantageous rate closer to completion.

3. Signficant Capital Growth

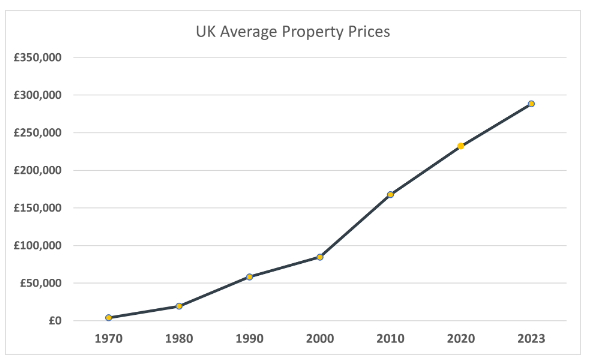

| The UK property market is often considered one of the safest investment vehicles in the world due to its long standing history of stability and consistent growth. Property prices have increased a staggering 3,547% since 1973, navigating through the exceptionally high interest rates of the 70’s and 80’s, the 2008 financial crash, Brexit and the Covid-19 pandemic. Despite tricky conditions in the past the UK market always continues on an upwards trojectory. Investing off-plan often allows investors to secure properties at lower prices compared to completed properties. This lower entry point provides an opportunity for significant capital growth as the property appreciates in value during the construction period. Additionally, off-plan properties are often built in premium central locations and areas of high re-generation of which demand the highest prices upon resale. See below for the average UK property prices since 1970. Source: HM Land Registry House Price Index. |